Hims & Hers Health: Expensive, You Say?

Hims & Hers Health (HIMS) is transforming healthcare with a personalized, vertically integrated platform, serving 2.2 million subscribers across men’s and women’s health, and generated $1.477 billion in annual revenue in 2024.

Its model prioritizes convenience and privacy, with at-home testing and tailored medications, strengthened by acquisitions like Trybe Labs and a peptide facility.

The $225 million weight loss segment faces FDA challenges on semaglutide, but HIMS counters with oral solutions and liraglutide, with the management targeting $750 million in 2025 weight loss revenue.

With $300 million in cash, zero debt, 85%+ retention, and a 77% revenue CAGR since 2021, HIMS forecasts 56-63% growth in 2025, supported by strong customer acquisition trends.

At $45.09 per share (4.3x 2025 sales), traditional metrics suggest a premium, but we believe HIMS is undervalued, making it a compelling long-term investment despite regulatory risks.

A Healthcare Revolution

Imagine answering a few online questions, consulting virtually with a doctor, and receiving a personalized prescription delivered to your door at a fraction of the usual cost—without the embarrassment of purchasing sensitive medications in person or the hassle of visiting a doctor or pharmacy. With ongoing practitioner support, at-home blood testing, and tailored medications, Hims & Hers Health offers a comprehensive healthcare solution. Launched in 2017 with a focus on men's wellness, addressing issues like hair loss and erectile dysfunction, the company has grown into a $10.02 billion market-cap leader, serving 2.2 million subscribers across five key verticals: sexual health, hair care, dermatology, mental health, and weight loss. The women's health segment, encompassing menopause, skincare, and anxiety, now matches the scale of men's offerings, with dermatology growing 55% for men and 100% for women in Q4 2024. In 2024, HIMS generated an estimated $825 million from men's products and $675 million from women's products, reflecting the balanced contribution of both segments to its $1.5 billion total revenue.

Hims & Hers Health is changing the way we use telehealth by offering accessible and personalized care. With an estimated market potential of $100 billion to $150 billion in 2025, there’s a lot of room for the company to grow and reach more people.

Business Model: What Makes HIMS Unique

The strength of HIMS lies in its vertically integrated platform, which manages the entire healthcare journey. Patients engage through a digital survey, consult with affiliated doctors remotely, and receive prescriptions from HIMS’ in-house pharmacies—503A for patient-specific compounding, such as custom GLP-1 doses, and 503B for bulk production through MedisourceRx, acquired in September 2024. Medications are then shipped directly to customers. The majority of fulfillment and distribution for HIMS is managed by affiliated pharmacies, namely XeCare and Apostrophe Pharmacy, which operate exclusively for the HIMS platform. These two entities play a critical role in the company’s supply chain: XeCare focuses on preparing and shipping a wide range of prescription medications tailored to HIMS’ customers, while Apostrophe Pharmacy specializes in compounding and distributing dermatological treatments and other personalized therapies prescribed through HIMS’ telehealth services. Together, they ensure that orders are fulfilled accurately and delivered discreetly to patients. However, HIMS does not currently own XeCare or Apostrophe Pharmacy outright. The company is still in the process of transitioning them into wholly owned subsidiaries, a shift that requires state regulatory approvals. If these approvals are delayed, the transition could disrupt HIMS’ operations, potentially impacting on the timely delivery of medications to customers. MedisourceRx, now fully integrated, enhances bulk compounding, strengthening supply chain control. This end-to-end oversight allows HIMS to reduce costs and offer competitive pricing, such as $165 per month for compounded semaglutide compared to Wegovy’s $1,300, and $79 per month for oral weight loss kits versus hundreds elsewhere.

HIMS’ business model centers on convenience, affordability, and personalization, supported by subscription plans that ensure recurring revenue and predictability. The platform leverages a closed-loop system, utilizing anonymized data from 2.2 million users to power MedMatch AI, which tailors treatments for each individual. Central to this personalization is MedMatch AI, an advanced system that harnesses this vast dataset to craft tailored treatment plans. By analyzing comprehensive user data—including medical histories, health conditions, lifestyle preferences, and diagnostic results—MedMatch AI employs machine learning algorithms to predict optimal treatments. For instance, it can recommend precise GLP-1 dosages or adjust dermatological compounds based on individual responses. This AI-driven approach enhances treatment efficacy, improves operational efficiency by reducing prescribing guesswork, and lowers healthcare delivery costs. Additionally, MedMatch AI provides strategic insights for product development, such as peptide-based treatments, strengthening HIMS’ competitive edge. However, it requires stringent data privacy measures and careful management to avoid algorithmic bias, which HIMS addresses through regulatory compliance and clinician oversight. As of Q4 2024, 55% of subscribers opted for tailored plans, up from 44% in Q2, highlighting the growing reliance on MedMatch AI for personalized care.

Recent Acquisitions: Expanding Capabilities

In 2024, HIMS acquired Trybe Labs in February 2025 and a California peptide manufacturing facility in December 2024. Trybe Labs, an at-home diagnostics provider, enables patients to test heart, hormone, liver, thyroid, and prostate biomarkers from home, syncing results with MedMatch for customized treatments, such as peptides for recovery or GLP-1 adjustments for weight loss. CEO Andrew Dudum noted in Q4, “It’s healthcare’s deepest dataset,” with 65% of GLP-1 users pairing testing with treatment. The peptide facility opens doors to next-generation treatments, including metabolic optimization, cognitive enhancement, and recovery solutions, targeting conditions like menopause, low testosterone, and anti-aging, with pilots hinted for 2025. These expansions introduce new regulatory requirements, including compliance with the Federal Food, Drug, and Cosmetic Act (FDCA), the Clinical Laboratory Improvement Amendments (CLIA), and current Good Manufacturing Practices (cGMP), alongside oversight from agencies like the FDA and CMS. Non-compliance could lead to penalties or disruptions, but HIMS appears well-positioned to navigate these challenges.

Challenges: Navigating the GLP-1 Transition

HIMS’ weight loss segment, a $225 million revenue driver in 2024, has seen its growth fueled by GLP-1 medications amid the semaglutide shortage. The segment’s expansion has been driven by compounded GLP-1 medications like semaglutide, with HIMS entering the market in May 2024 offering compounded injectable semaglutide, followed by branded (FDA-approved) semaglutide in August 2024. However, the FDA’s February 21, 2025, decision to end the semaglutide shortage threatens this vertical. Regulatory changes will terminate 503A compounding (patient-specific prescriptions) by April 22, 2025, and 503B production (large-scale, non-patient-specific drugs) by May 22, 2025, following the availability of all Ozempic and Wegovy doses since October 30, 2024. This eliminates HIMS’ ability to leverage the 503B shortage exemption for large-scale production, potentially leading to a $180 million revenue shortfall after Q1 2025 as compounded inventory depletes.

To provide context, GLP-1 (glucagon-like peptide-1) medications, including semaglutide, are a class of drugs that mimic a hormone to regulate blood sugar and appetite, making them highly effective for weight loss. Semaglutide, marketed as Ozempic and Wegovy by Novo Nordisk, faced a prolonged shortage, creating demand that HIMS capitalized on with compounded versions—custom-made alternatives produced by pharmacies when commercial drugs are unavailable.

HIMS is countering these challenges with a plan to sustain GLP-1 access through the 503A exemption, which allows patient-specific prescriptions when “clinically necessary”—such as unique doses or allergy considerations. CEO Andrew Dudum emphasized during the last earnings call, “Millions need custom solutions—legal and ethical.” The company emphasizes a clear and detailed intake process designed to help each patient. This process includes two key parts:

Custom plans for medication adjustment: These are personalized schedules that carefully change a patient’s medication step by step, tailored to their specific needs.

MedMatch technology: A tool that finds the best treatment match for each individual.

Together, these ensure patients get the most effective results while keeping side effects as low as possible. However, this approach faces hurdles:

Supply Chain Constraints: Limited raw material availability could disrupt production.

Intellectual Property Challenges: Novo Nordisk’s patents may lead to legal battles over compounding rights.

Regulatory Uncertainty: In 2024, Novo Nordisk and Eli Lilly pushed the FDA to add semaglutide and tirzepatide to its “Demonstrable Difficulties for Compounding List,” which could ban compounding entirely if finalized. The FDA’s handling of tirzepatide—removed from the shortage list in October 2024 and reaffirmed in December despite litigation—signals a potential crackdown on semaglutide.

Ongoing lawsuits, heightened FDA and state scrutiny of compounding pharmacies, and negative media coverage on quality concerns further complicate the outlook, with legal disputes potentially denting HIMS’ brand or revenue.

HIM’s Diversified Growth Strategies for the Weight Loss Segment

Despite these risks, HIMS is strategically positioned to maintain growth in its weight loss segment through a versatile approach:

Oral Weight Loss Solutions: Launched in 2024, these kits, priced at $79 per month, hit a $100 million-plus run-rate within seven months. Offering 70% of GLP-1’s efficacy, they are scalable, cost-effective, and immune to shortage-related regulatory shifts. HIMS projects $253.75 million in revenue from this category in 2025.

Liraglutide Introduction: Expected for mid-2025 or early second half, per CFO Yemi Okupe’s earnings call remarks, HIMS will roll out liraglutide, a generic GLP-1 medication delivering approximately 6.4% weight loss (versus semaglutide’s 15.8%). Priced potentially in the couple of hundred dollar range per month—balancing affordability with higher production costs—it’s expected to generate $150 million in revenue, capitalizing on HIMS’ compounding expertise.

In contrast to the high costs of branded semaglutide options like Ozempic ($935 per month) and Wegovy ($1,350 per month), HIMS' oral weight loss solutions are priced at $79 per month, and liraglutide is expected to be in the couple of hundred dollar range per month. This significant price difference underscores the affordability of HIMS' offerings, which is a key factor in retaining customers who may not be able to afford the branded drugs.

Revenue Projections Break-Down for the Weight Loss Segment

HIMS anticipates the weight loss segment will generate at least $725 million in 2025, excluding commercial semaglutide sales after Q1, despite their continuation until May 22 under the 503B exemption. Including sales until April-May, I believe that the total revenue for the segment could approach $811 million, as per the breakdown here below:

Oral Weight Loss Solutions: Expected to contribute $235.75 million, driven by a $100 million run-rate from 2024 and increased demand following the phase-out of commercial semaglutide.

Liraglutide: Projected to add $150 million, starting from its launch in mid-2025.

Semaglutide: Forecasted at $339.25 million for the full year, operating under the 503A exemption, and around $86 million of commercial Semaglutide which can be sold through May 22 under the 503B exemption.

This mix offsets the $180 million loss from commercial semaglutide’s exit, driving substantial growth toward and probably beyond HIMS’ $750 million segment target.

I am fully aware that this transition carries challenges and risks—liraglutide’s lower efficacy may affect adoption, and ongoing legal disputes over personalized semaglutide compounding persist. If compounding is banned or restricted, supply constraints could lead to higher prices and reduced margins, potentially decreasing customer demand, increasing cancellations, and impacting revenue, gross profit, brand reputation, and ultimately the stock price. However, HIMS’ proactive diversification into oral solutions and alternative GLP-1 drugs positions it well to navigate this shift for 2025. Given the high costs of branded semaglutide options, such as Ozempic and Wegovy, HIMS has a real chance to retain patients with its less effective alternatives, like liraglutide and oral solutions, primarily because many of these patients likely could not afford the branded drugs in the first place, making affordability a decisive factor in their continued loyalty.

HIMS: Rules of Attraction

Since its launch in 2017, HIMS has focused on growing its customer base through targeted marketing, a strong brand presence, and strategic acquisitions. In 2024, the company invested $678.8 million in marketing—about 46% of its revenue—to reach new audiences. Customer acquisition costs increased by 57% to $594.5 million, but the effort paid off as revenue growth exceeded these expenses. HIMS relied on digital platforms like search ads, streaming TV, podcasts, and affiliate partnerships, with a particular focus on its new weight loss products.

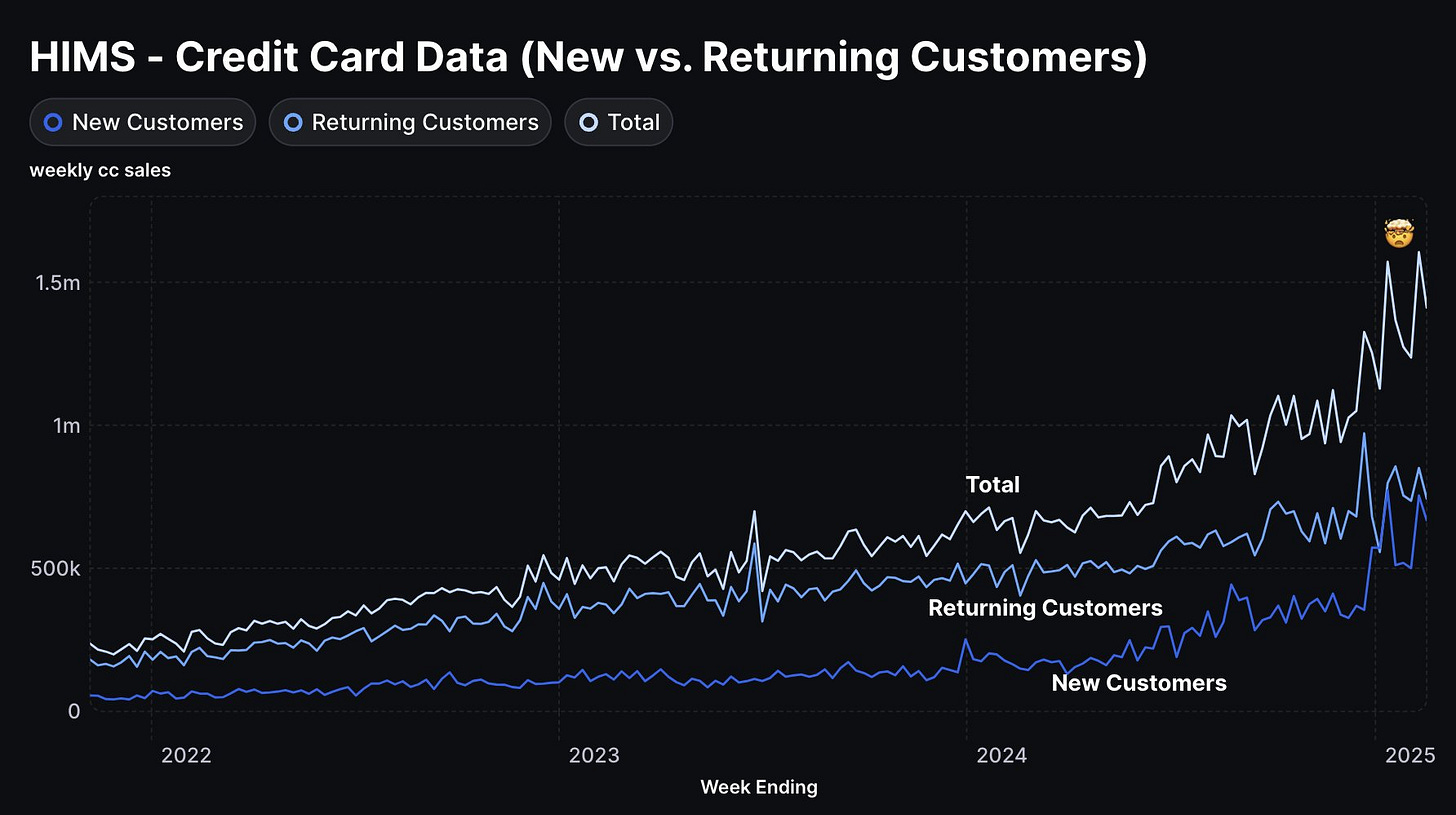

Credit card data reflects the success of this strategy, showing steady sales growth from 2022 into early 2025, with 1.5 million transactions by the end of the year. Returning customers play a big role, spending nearly twice as much as new customers by early 2025, highlighting the stickiness of the platform: HIMS is able to keep its users and sell them additional products.

(Source: Hims House)

The brand’s visibility has also risen steadily. On Reddit, the r/HIMS community grew from 2,000 members in September 2023 to 8,000 by February 24, 2025, indicating strong interest in weight loss offerings.

(Source: Hims House)

Google Trends data shows that searches for “hims” climbed to over 800,000 by January 2025, boosted by a Super Bowl ad and the release of oral weight loss kits.

(Source: Hims House)

Albeit seasonal patterns add to this momentum (each Q1, New Year’s resolutions bring in new users, driving 2024 weight loss revenue to $225 million), many new subscribers choose higher-priced plans, setting HIMS up for a projected $520–$540 million in Q1 2025. With retention rates above 85%, these seasonal gains lead to lasting growth as customers explore other services like skincare or mental health support, opening doors for additional sales.

Retention and Cross-Selling: Securing Loyalty and Expanding Revenue

HIMS stands out for its ability to retain customers and encourage them to buy more, strengthening both its stability and growth. The platform’s retention rates are notable, with 70% of GLP-1 users remaining active at 12 weeks, compared to an industry average of 42%. By Q4 2024, long-term retention exceeded 85%, providing steady revenue from subscribers who stick around after two years. While changes in customer habits or economic pressures like inflation could pose challenges, the outlook remains solid, especially give the importance and the attractiveness of HIMS’s value proposition.

HIMS ability to effectively carry out cross-selling further boosts revenue per user. In Q4 2024, monthly online revenue per subscriber rose 38% year-over-year to $73 from $53 in Q4 2023, thanks to newer products like GLP-1s and oral weight loss solutions. During Q3 2024, 20,000 existing subscribers added weight loss solutions, and 20% of those users engaged with other specialties, such as dermatology or mental health. With 300,000 users tackling two or more conditions in Q3, HIMS is turning one-time buyers into long-term customers, increasing both engagement and spending. The asset turnover ratio climbed to 2.57 in 2024 from 1.15 in 2019, showing how efficiently HIMS generates revenue from its platform. This blend of strong retention and effective cross-selling highlights the company’s knack for building lasting customer relationships while maximizing value.

Is HIMS Stock a Good Buy at $45.09?

HIMS is a high-growth company demonstrating exceptional performance. In Q4 2024, revenue surged by an impressive 95.1% year-over-year. Looking ahead, management forecasts growth between 56% and 63% for 2025, building on an average annual growth rate of 77% since 2021.

HIMS is currently trading at 4.3 times its expected 2025 sales, based on a market cap of $10.02 billion and projected sales of $2.3 billion to $2.4 billion. For a company growing at this rate, a price-to-sales (P/S) ratio of 4.3 is reasonable—investors often pay a premium for such high-growth potential. However, the trailing price-to-earnings (P/E) ratio stands at 83.50x, which seems expensive. The forward P/E, based on next year’s expected earnings, improves slightly to 76.5x.

On the cash flow front, HIMS is a beast. In 2024, it generated $209.4 million in free cash flow (with a margin of 13.43%)—a remarkable 400% increase from the prior year—while maintaining gross margins of 79%. Unlike many high-growth companies that burn cash, HIMS is scaling efficiently and profitably. Its current price-to-free cash flow (P/FCF) ratio is 47.84x, which also may seem elevated but aligns with its growth trajectory. As per the forward P/FCF ratio, with $209.4 million in free cash flow in 2024 and assuming a conservative growth rate of 50% in 2025—below the revenue growth forecast of 56% to 63%—free cash flow could reach approximately $314.1 million in 2025. Based on the current market cap of $10.02 billion, this results in a forward P/FCF ratio of about 31.9x ($10.02 billion / $314.1 million).

A Different Perspective: Adjusted Earnings Valuation

Traditional metrics might undervalue HIMS by treating its significant spending on marketing ($678.8 million in 2024) and research and development ($78.8 million) as typical operating expenses. Instead, these can be viewed as strategic investments in future growth. Marketing drives customer acquisition, with over 85% of users staying loyal, creating a reliable recurring revenue stream. R&D fuels innovations like the MedMatch AI tool, enhancing HIMS’s platform and supporting long-term expansion.

If we adjust for this by adding marketing and R&D expenses back to the net income, this latter rises from $126 million to $883.6 million. At the current stock price of $45.09, this means an adjusted P/E ratio of 11.35x. Compared to the healthcare sector’s median P/E of 28.5x, HIMS appears significantly undervalued for a company with this growth profile.

Risks

Investing in HIMS comes with several risks. The telehealth industry is highly competitive, with established players like Teladoc, Ro, and Amazon fiercely fighting for market share. Regulatory risks are also significant; beyond the GLP-1 specific concerns previously mentioned, broader regulatory changes could disrupt HIMS's operations, which rely on permissive online prescription policies. Additionally, while HIMS's substantial marketing spend has been effective in driving strong customer retention, this strategy could backfire if specific drugs underperform, potentially weakening retention rates.

Conclusion

At $45.09, HIMS stock appears undervalued when considering its growth prospects and adjusted valuation metrics. Traditional measures like the trailing P/E of 83.50x or P/FCF of 47.84x might suggest the stock is pricey, but the adjusted P/E of 11.35x—considering marketing and R&D expenses as capital expenditures (investments) and not operating expenditures—reveals a bargain relative to the healthcare sector median of 28.5x. Pair this with extraordinary revenue growth, robust free cash flow, and a forward P/FCF ratio of 31.9x for 2025, and HIMS offers compelling value.

Risks exist, but for investors comfortable with a high-growth telehealth play, HIMS stands out as a strong opportunity. Given the stock’s high volatility, its price remains appealing up to $65 (adjusted P/E of 16.34x), offering compelling range (from $40 to $65) that could serve as a strong entry point for investors looking to build a position and hold the stock for the long-term.

Thank You for Reading

If you found this article valuable, feel free to like and share it.

Ownership Disclosure

I currently hold a long position in Hims & Hers Health (HIMS).

Legal Disclaimer

The information provided in this publication is for informational and educational purposes only and should not be construed as financial or investment advice. The content is based on personal opinions and is subject to interpretation.

Nothing published under Bermuda Hills Research constitutes an offer, solicitation, or recommendation to buy or sell any securities, stocks, or other financial instruments. Any investment decisions based on this content are made at your own risk.

Investing in financial markets, including in publicly traded companies, carries inherent risks, including potential loss of capital. You should conduct your own due diligence and consult with a qualified financial professional before making any investment decisions.

The accuracy, completeness, or reliability of the information presented in this article is not guaranteed. While I make efforts to provide accurate and timely information, I do not assume any liability for errors, omissions, or any losses incurred as a result of reliance on this content.

By reading this publication, you acknowledge and agree that Bermuda Hills Research and I are not responsible for any financial outcomes resulting from your actions.